Loyalty programmes are par for the course for many New Zealand retailers and banks.

In fact, 97% of Kiwis are members of some form of retail loyalty programme.

Conventional wisdom says rewarding customers leads to greater loyalty, but Visa’s new research shows there’s more to it than that.

We commissioned a comprehensive study of retail brand and credit card loyalty programmes, and how they need to pivot to build truly loyal – and engaged – Kiwi customers.

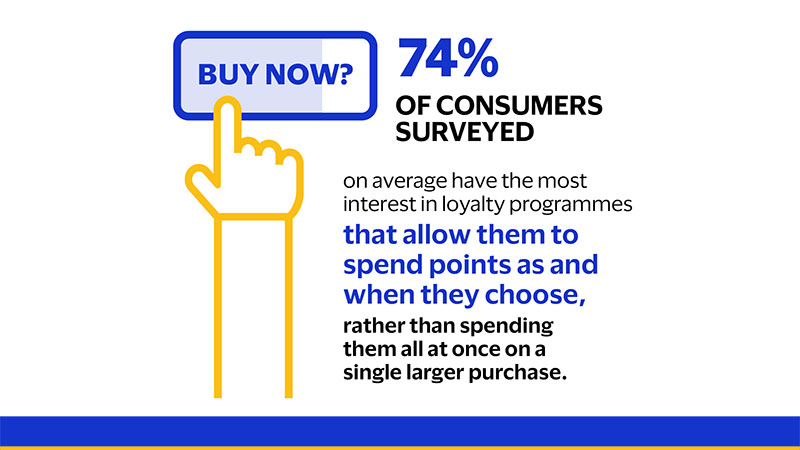

The research shows that Kiwi customers are leaning into loyalty programmes that reward them with instantaneous possibilities for spending: it’s more about ”spending what I’ve earnt right now” and “getting something for nothing straight away”, than squirreling away points for a rainy day. This shift has taken place alongside massive digital acceleration, which has forever altered the commerce paradigm and puts digital experience front and centre.

Our investigation also reveals that to build truly loyal and engaged customers, retailers and financial institutions must leapfrog from ‘tried and true’ methods towards new solutions – enabled by digital experience and innovations – that create instant brand affinity. Businesses should consider using numerous tactics like helping customers with value-add products such as budgeting tools and webinars, enhancing apps with banking and investment options, and deploying a more empathic user experience.

The rewards experience should be increasingly real-time, dynamic, targeted and gamified.

All of these tactics work in harmony to enhance loyalty programmes – and lead to a point where brand and loyalty meet to forge strong and enduring emotional connections with customers.

We hope these new customer loyalty findings help Kiwi businesses attract and retain customers, and ultimately win the loyalty and customer engagement game in 2022 and beyond.